You (as a CFO) are being asked to drive growth, reduce overhead, and manage risk, while your IT environment continues to grow in complexity.

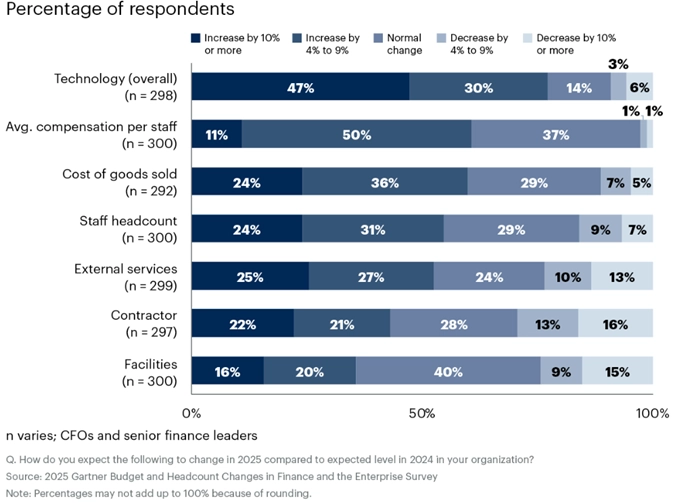

According to a recent Gartner survey, 77% of CFOs plan to increase their technology budgets in 2025, and 47% expect a 10% or more boost by next year. That tells you something: technology is no longer an optional line item; it’s central to financial strategy.

By partnering with a Gen AI-powered managed service provider, you gain access to scaled expertise, tighter cost control, predictable models, and faster modernization.

At Sthenos, we’ve helped finance leaders transform their IT spend into strategic leverage. In this blog post, we’ll walk through how such partnerships work, what you should look for, how you’ll measure outcomes, and why now is the right time for you.

The CFO Role Has Expanded Beyond Finance

Source: Gartner

Once upon a time, the CFO’s domain was purely financial reporting, budgeting, and compliance. Today, your remit touches technology, operations, risk, and innovation.

According to a Rimini Street survey of nearly 3,000 CFOs and CIOs, 72% of CFOs say they now lead the technology budget, and 41% of CIOs say their CFO counterpart makes key tech decisions.

Furthermore, another article reports that 82% of CFOs reported an increase in responsibility for IT spend control over the last year.

What that means for you: you’re not only approving numbers, but you’re deciding where technology investments will generate value or risk. A managed service model built on Gen AI becomes a lever for you to drive efficiency, predictability, and growth.

Read More: Why Legacy System Modernization Needs a Gen-AI Approach

How Gen AI MSPs Change the Financial Equation

When you partner with a Gen AI-led managed service provider, you change more than the vendor relationship. You vary the cost structure, time to value, and risk profile. Here’s how:

Greater Visibility in Technology Spending

You should see line-by-line clarity of what drives your IT cost, what delivers business value, and what doesn’t. Studies show that better transparency yields concrete gains. For example, a new research by The Hackett Group found that companies with high spend visibility achieved purchase cost savings averaging 7.8% of spend annually, compared to 3.7% in low-visibility firms.

This leads to enhanced cost control, fewer surprises, and greater clarity around the link between technology spending and business impact.

Faster Response and Resolution

Time is money when IT issues affect production or finance processes. A managed service provider with advanced analytics and automation means you’re not waiting for manual firefighting.

According to research, autonomous sourcing and spend platforms enabled firms to reduce sourcing cycle times by 31% (from 61 to 42 business days) and cut late deliveries by 72%.

For you, that means lower time lost, a decrease in interruptions, and better resource responsiveness across the finance framework.

Superior Forecasting and Budgetary Planning

You know the drill for aligning budgets, income estimates, and risk estimates. Now you also need to forecast IT spend. Cloud cost, licenses, maintenance, and infrastructure expenses can swing.

According to another source, companies waste as much as 30% of their cloud budget due to inefficiencies. Working with a managed service provider gives you a model that is more predictable, more controllable, and tied to the KPIs you care about.

Read More: What is Organizational Change Management & Why Is It Important?

Smarter Modernization Decisions

Legacy systems cost you not just dollars today but opportunity tomorrow. A managed service provider that brings automation and analytics helps you identify which systems to modernize, retire, or optimize. That makes your roadmap smarter and your modernization budget leaner.

Why CFOs Gain a Cost Advantage Through These Partnerships

Let’s look at actual cost levers that matter:

Lower Maintenance Costs

When you outsource recurring support tasks, apply automation and use provider economies of scale, and maintenance costs drop.

Companies using advanced sourcing or automation reported average cost reductions of around 20%. For you, that means budget freed for strategic initiatives instead of just keeping lights on.

Optimized Cloud and Infrastructure Spend

Pay-as-you-go models are only efficient when managed. Over-provisioning, orphan instances, and idle licenses cost a lot. Research highlighted that companies waste up to 30% of their cloud budget from poor optimisation.

A good provider monitors and rightsizes your infrastructure, giving you cost predictability and resource optimisation.

Reduced IT Downtime

Any downtime, for even a short period, has a negative financial impact on revenue, compliance, or productivity. If a service vendor can achieve a lower mean time to repair and shift your model to preventive, you have fewer interruptions, fewer emergency repairs, and better business continuity.

Avoided Capital Expenditure

Hiring internal talent, building a big team, and purchasing software and infrastructure have a heavy upfront cost. A managed service model allows you to shift from a large capital expense (CapEx) to a predictable operational expense (OpEx). This aligns with your focus on funding working capital to get more economic benefit for each dollar spent.

Read More: Why Digital Initiatives Fail Without Change Management

Driving Efficiency Across Finance and Operations

Beyond cost savings, your finance organisation gains operational strength when IT runs smoothly.

Real-time Reporting and Dashboards

You need timely insights—not when the monthly close is done but when exceptions occur. A managed service provider gives you dashboards that show system health, operational metrics, spend tracking and risk exposures. That gives you confidence and control.

Better Data Quality

Poor data affects forecasting, reconciliation, risk modelling, and audit. A partner that ensures your systems are clean, integrated, and compliant reduces error rates, audit costs and downstream issues. Many firms report significant improvements in data reliability when technology and finance align.

Faster Execution Cycles

However, when your IT operations become inflexible with bottlenecks throughout, you’re less adaptive to changing requirements quickly as the business landscape changes.

Your IT infrastructure evolved very quickly, for new product launches, enterprise market opportunities, or to acquire an integrated facility.

A managed service partner accelerates execution by freeing up internal teams and aligning processes with the finance rhythm.

Read More: The Role of Leadership in Successful Digital Transformation

Modernizing Legacy Systems Without Disruption

Legacy systems are expensive, brittle and slow to adapt — yet going “all in” on modernization is risky. The managed service model helps you modernize with discipline.

Automated Discovery

Understanding what you have—and what it does—is the first step. According to industry practitioners, unearthing hidden dependencies and “what-if” scenarios through automation reduces surprises later in the project lifecycle. That ensures you’re not budgeting for “unknowns”.

Prioritised Modernization Roadmap

You don’t modernize everything at once. You pick the systems where the business value and cost reduction are highest. A partner helps you map that roadmap, pick quick wins, and move strategically. You avoid costly disruptions and build momentum.

Lower Long-Term Technical Debt

When you modernize well, you prevent patchwork, stopgap fixes, and inefficient code. The long-term benefit is lower maintenance cost, fewer vendor constraints, and a more flexible architecture. As a CFO, you benefit from lower total cost of ownership (TCO) over time.

Why CFOs Are Shifting Toward Gen AI-Enabled MSPs

Here are the reasons we see CFOs making this shift now:

- Predictable monthly cost model instead of unknown spikes.

- Access to specialist talent, automation, cloud, and security without large internal hiring.

- Faster time-to-value — partner brings experience, frameworks, and tools.

- Stronger controls, governance, and compliance baked in (important when you control budgets).

- Flexibility to ramp up and down operations in line with business normal cycles.

As one article indicates, 86% of collaborating CFO’s and CIOs said their collaboration had deepened during capital technology initiatives, which speaks to the collaborative aspect.

This is not about replacing your IT department. It’s about supplementing and accelerating it, freeing your finance team to focus on strategy and value-creation rather than firefighting.

How Sthenos Supports CFOs in This Journey

At Sthenos, we understand how finance and IT work together. We start with your goals (cost control, efficiency, modernization), not the other way around.

Here’s how we help:

- We begin with spend visibility workshops and technology audits so you understand your baseline.

- We deploy our managed service platform with automation and operational metrics aligned with your finance KPIs.

- We build modernization roadmaps, such as identifying legacy systems, prioritizing migration, and managing risk and cost.

- We provide real-time reporting, dashboards, and governance frameworks so you stay in control.

- We maintain compliance, security, and service levels so your risk exposure remains low.

In one recent engagement, we helped a finance head of a manufacturing firm reduce support ticket resolution time by 45%, cut infrastructure spend by 18% and freed up the finance team to redeploy two staff to analytics projects.

When you work with us, you get a partner who speaks your language, i.e., cost, value, risk, performance. And you get technology that delivers.

Bottom Line

As a CFO, you are in the driver’s seat of both financial performance and operational agility. Partnering with a Gen AI-powered MSP provides you with a model to control IT spend and turn it into a competitive advantage.

It’s time to act if you are facing rising IT costs, aging systems, unpredictable spending, or slow processes within your organization.

You should partner with a provider that can give you visibility, predictability, efficiency, and modernization. This will allow you to concentrate on leading the business processes.

At Sthenos, we’re ready to help you map the path, measure the impact, and deliver the results. Let’s talk about how you can transform your IT environment from a cost centre to a growth engine.